Reitar Logtech Celebrates Its NASDAQ Listing with a Closing Bell-Ringing Ceremony

On the afternoon of September 19, 2024 (EST), Mr. John Chan, Chairman and Chief Executive Officer of Reitar Logtech Holdings Limited (“Reitar Logtech”, NASDAQ: RITR), rang the closing bell of the NASDAQ Stock Exchange at the NASDAQ Tower in Times Square, New York.

Reitar Logtech Holdings Limited Announces Full Exercise of Over-Allotment Option

Reitar Logtech Holdings Limited Announces Full Exercise of Over-Allotment Option September 13, 2024 Hong Kong, September 13, 2024 — Reitar Logtech Holdings Limited (Nasdaq: RITR) (the “Company”), a comprehensive logistics solutions provider in Hong Kong, today announced that Cathay Securities, Inc., as representative of the underwriters of the Company’s firm commitment initial public offering (the “IPO” or the “Offering”), has exercised its over-allotment option in full to purchase an additional 318,750 additional Class A Ordinary Shares of the Company (the “Class A Ordinary Shares”) at the IPO price of $4.00 per share. The total gross proceeds that the Company will receive from the IPO, including the proceeds from the underwriters’ exercise of the over-allotment option in full, is approximately $9.8 million, before deducting underwriting discounts and other related expenses. The Class A Ordinary Shares began trading on the Nasdaq Capital Market on August 23, 2024, under the symbol “RITR”. Proceeds from the Offering will be used by the Company primarily for (i) expanding its resources and investing in state-of-the-art logistics facilities, (ii) building its in-house research and development capabilities, (iii) expanding the geographic coverage of its market, (iv) investing in logistics projects and (v) other working capital and general corporate purposes. The Offering is being conducted on a firm commitment basis. Cathay Securities, Inc. is acting as sole book runner and lead underwriter for the Offering. A registration statement on Form F-1 relating to the Offering has been filed with the U.S. Securities and Exchange Commission (“SEC”) (File Number: 333-278295) and was declared effective by the SEC on August 16, 2024. The Offering was made only by means of a prospectus. A final prospectus relating to the Offering was filed with the SEC on August 23, 2024 and may be obtained from Cathay Securities Inc., 40 Wall St., Suite 3600, New York, NY 10005, or via email at ipo@cathaysecurities.com. In addition, a copy of the final prospectus relating to the Offering may be obtained via the SEC’s website at www.sec.gov. This press release has been prepared for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy any securities, and no sale of these securities may be made in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction. Forward-Looking Statements Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s registration statement and other filings with the SEC, which are available for review at www.sec.gov. About Reitar Logtech Holdings Limited Reitar Logtech Holdings Limited provides comprehensive logistics solutions by connecting capital partners, logistics operators, and our innovative integration and application of logistics technologies through our end-to-end logistics solution business model. Its business primarily consists of two segments: (i) asset management and professional consultancy services, and (ii) construction management and engineering design services. For more information, please contacts:Reitar Logtech Holdings LimitedPhone: +852 2554 5666Email: info@reitar.io 只備有英文版 English version ONLY 只备有英文版 English version ONLY Other News All Post Press Releases September 13, 2024 Reitar Logtech Holdings Limited Announces Full Exercise of Over-Allotment Option Reitar Logtech Holdings Limited Announces Full Exercise of Over-Allotment Option September 13, 2024 Hong Kong, September 13, 2024 — Reitar Logtech Holdings Limited (Nasdaq: RITR) (the “Company”), a comprehensive logistics solutions provider in Hong Kong, today announced that Cathay Securities, Inc., as representative of the underwriters of the Company’s firm commitment initial public offering (the “IPO” or the “Offering”), has… Read More August 26, 2024 Reitar Logtech Holdings Limited Announces Closing of Initial Public Offering Reitar Logtech Holdings Limited Announces Closing of Initial Public Offering August 26, 2024 Hong Kong, August 26, 2024 — Reitar Logtech Holdings Limited (Nasdaq: RITR) (the “Company”), a comprehensive logistics solutions provider in Hong Kong, today announced the closing of its initial public offering (the “Offering”) of 2,125,000 Class A ordinary shares at a price of $4.00 per share. The… Read More August 23, 2024 Reitar Logtech Holdings Limited Announces Pricing of Initial Public Offering and Listing on Nasdaq Reitar Logtech Holdings Limited Announces Pricing of Initial Public Offering and Listing on Nasdaq August 23, 2024 Hong Kong, August 23, 2024 — Reitar Logtech Holdings Limited (Nasdaq: RITR) (the “Company”), a comprehensive logistics solutions provider in Hong Kong, today announced the pricing of its initial public offering (the “Offering”) of 2,125,000 Class A ordinary shares (the ” Class A… Read More

Exploring the ‘Super Capital Engine’ of Smart Logistics: Five Key Benefits of RBF!

RBF is increasingly becoming a key driver in the smart logistics sector. This model not only alleviates companies’ financial pressures but also fosters innovation and market expansion.

Revenue-Based Financing: A Financial Lifeline for the Logistics Industry

The logistics industry is currently grappling with significant challenges, including business expansion, technology upgrades, and supply chain management. As companies strive to upgrade to smart logistics level, there is an urgent need for substantial financial support. One solution gaining traction is Revenue-Based Financing (RBF), which offers a flexible approach to cash flow management.

Reitar Logtech Holdings Limited Successfully Listed on Nasdaq

Reitar Logtech Holdings Limited (“Reitar Logtech”) (NASDAQ: RITR) has officially listed on the Nasdaq stock market on August 23, 2024. This marks an important milestone in the company’s internationalization, also signifies Reitar Logtech’s commitment to driving the formation of smart logistics ecosystem, injecting new momentum into the industry.

Capital Flow Fuels Endless Possibilities in Smart Logistics

At the core of smart logistics development, the strongest driving force is undoubtedly ” Capital flow “.

Reitar Logtech Holdings Limited Announces Closing of Initial Public Offering

Reitar Logtech Holdings Limited Announces Closing of Initial Public Offering August 26, 2024 Hong Kong, August 26, 2024 — Reitar Logtech Holdings Limited (Nasdaq: RITR) (the “Company”), a comprehensive logistics solutions provider in Hong Kong, today announced the closing of its initial public offering (the “Offering”) of 2,125,000 Class A ordinary shares at a price of $4.00 per share. The aggregate gross proceeds from the Offering were $8.5 million, before deducting underwriting discounts and other related expenses. The ordinary shares began trading on The Nasdaq Capital Market on August 23, 2024 under the ticker symbol “RITR.” The Offering is being conducted on a firm commitment basis. Cathay Securities, Inc. is acting as sole book runner and lead underwriter for the Offering. A registration statement on Form F-1 relating to the Offering has been filed with the U.S. Securities and Exchange Commission (“SEC”) (File Number: 333-278295) and was declared effective by the SEC on August 16, 2024. The Offering was made only by means of a prospectus. A final prospectus relating to the Offering was filed with the SEC on August 23, 2024 and may be obtained from Cathay Securities Inc., 40 Wall St., Suite 3600, New York, NY 10005, or via email at ipo@cathaysecurities.com. In addition, a copy of the final prospectus relating to the Offering may be obtained via the SEC’s website at www.sec.gov . This press release has been prepared for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy any securities, and no sale of these securities may be made in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction. Forward-Looking Statements Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s registration statement and other filings with the SEC, which are available for review at www.sec.gov. About Reitar Logtech Holdings Limited Reitar Logtech Holdings Limited provides comprehensive logistics solutions by connecting capital partners, logistics operators, and our innovative integration and application of logistics technologies through our end-to-end logistics solution business model. Its business primarily consists of two segments: (i) asset management and professional consultancy services, and (ii) construction management and engineering design services. For more information, please contacts:Reitar Logtech Holdings LimitedPhone: +852 2554 5666Email: info@reitar.io 只備有英文版 English version ONLY 只备有英文版 English version ONLY Other News All Post Press Releases September 13, 2024 Reitar Logtech Holdings Limited Announces Full Exercise of Over-Allotment Option Reitar Logtech Holdings Limited Announces Full Exercise of Over-Allotment Option September 13, 2024 Hong Kong, September 13, 2024 — Reitar Logtech Holdings Limited (Nasdaq: RITR) (the “Company”), a comprehensive logistics solutions provider in Hong Kong, today announced that Cathay Securities, Inc., as representative of the underwriters of the Company’s firm commitment initial public offering (the “IPO” or the “Offering”), has… Read More August 26, 2024 Reitar Logtech Holdings Limited Announces Closing of Initial Public Offering Reitar Logtech Holdings Limited Announces Closing of Initial Public Offering August 26, 2024 Hong Kong, August 26, 2024 — Reitar Logtech Holdings Limited (Nasdaq: RITR) (the “Company”), a comprehensive logistics solutions provider in Hong Kong, today announced the closing of its initial public offering (the “Offering”) of 2,125,000 Class A ordinary shares at a price of $4.00 per share. The… Read More August 23, 2024 Reitar Logtech Holdings Limited Announces Pricing of Initial Public Offering and Listing on Nasdaq Reitar Logtech Holdings Limited Announces Pricing of Initial Public Offering and Listing on Nasdaq August 23, 2024 Hong Kong, August 23, 2024 — Reitar Logtech Holdings Limited (Nasdaq: RITR) (the “Company”), a comprehensive logistics solutions provider in Hong Kong, today announced the pricing of its initial public offering (the “Offering”) of 2,125,000 Class A ordinary shares (the ” Class A… Read More

Reitar Logtech Holdings Limited Announces Pricing of Initial Public Offering and Listing on Nasdaq

Reitar Logtech Holdings Limited Announces Pricing of Initial Public Offering and Listing on Nasdaq August 23, 2024 Hong Kong, August 23, 2024 — Reitar Logtech Holdings Limited (Nasdaq: RITR) (the “Company”), a comprehensive logistics solutions provider in Hong Kong, today announced the pricing of its initial public offering (the “Offering”) of 2,125,000 Class A ordinary shares (the ” Class A Ordinary Shares”) on August 22, 2024, at a price of $4.00 per Class A Ordinary Share. The Class A Ordinary Shares are expected to begin trading on the Nasdaq Capital Market on August 23, 2024 under the symbol “RITR”. The Offering is expected to close on August 26, 2024, subject to the satisfaction of customary closing conditions. The Company intends to use the net proceeds for expanding its resources and investing in state-of-the-art logistics facilities, for building its in-house research and development capabilities, for expanding the geographic coverage of its market, for investing in logistics projects and for other working capital and general corporate purposes. In addition, the Company has granted the underwriters a 45-day option to purchase up to an additional 318,750 Class A Ordinary Shares of the Company, at the Offering price, less underwriting discounts and commissions. The Offering is being conducted on a firm commitment basis. Cathay Securities, Inc. is acting as sole book runner and lead underwriter for the Offering. The Offering is being conducted pursuant to the Company’s Registration Statement on Form F-1 (File No. 333-278295) previously filed with, and subsequently declared effective by the U.S. Securities and Exchange Commission (the “SEC”) on August 16, 2024. The Offering is being made only by means of a prospectus. Before you invest, you should read the prospectus and other documents the Company has filed or will file with the SEC for more information about the Company and the Offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, electronic copies of the prospectus relating to the Offering may be obtained from Cathay Securities Inc., 40 Wall St., Suite 3600, New York, NY 10005, or via email at ipo@cathaysecurities.com. This press release has been prepared for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy any securities, and no sale of these securities may be made in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction. Forward-Looking StatementsCertain statements contained in this press release are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements reflect the Company’s current expectations or beliefs concerning future events and actual events may differ materially from current expectations. Any such forward-looking statements are subject to various risks and uncertainties, including the strength of the economy, changes to the market for securities, political or financial instability and other factors which are set forth in the Company’s Registration Statement on Form F-1 (File No. 333-278295), as amended, and in all filings with the SEC made by the Company subsequent to the filing thereof. The Company does not undertake to publicly update or revise its forward-looking statements, whether as a result of new information, future events or otherwise. About Reitar Logtech Holdings LimitedReitar Logtech Holdings Limited provides comprehensive logistics solutions by connecting capital partners, logistics operators, and our innovative integration and application of logistics technologies through our end-to-end logistics solution business model. Its business primarily consists of two segments: (i) asset management and professional consultancy services, and (ii) construction management and engineering design services. For more information, please contacts:Reitar Logtech Holdings LimitedPhone: +852 2554 5666Email: info@reitar.io 只備有英文版 English version ONLY 只备有英文版 English version ONLY Other News All Post Press Releases August 26, 2024 Reitar Logtech Holdings Limited Announces Closing of Initial Public Offering Reitar Logtech Holdings Limited Announces Closing of Initial Public Offering August 26, 2024 Hong Kong, August 26, 2024 — Reitar Logtech Holdings Limited (Nasdaq: RITR) (the “Company”), a comprehensive logistics solutions provider in Hong Kong, today announced the closing of its initial public offering (the “Offering”) of 2,125,000 Class A ordinary shares at a price of $4.00 per share. The… Read More August 23, 2024 Reitar Logtech Holdings Limited Announces Pricing of Initial Public Offering and Listing on Nasdaq Reitar Logtech Holdings Limited Announces Pricing of Initial Public Offering and Listing on Nasdaq August 23, 2024 Hong Kong, August 23, 2024 — Reitar Logtech Holdings Limited (Nasdaq: RITR) (the “Company”), a comprehensive logistics solutions provider in Hong Kong, today announced the pricing of its initial public offering (the “Offering”) of 2,125,000 Class A ordinary shares (the ” Class A… Read More

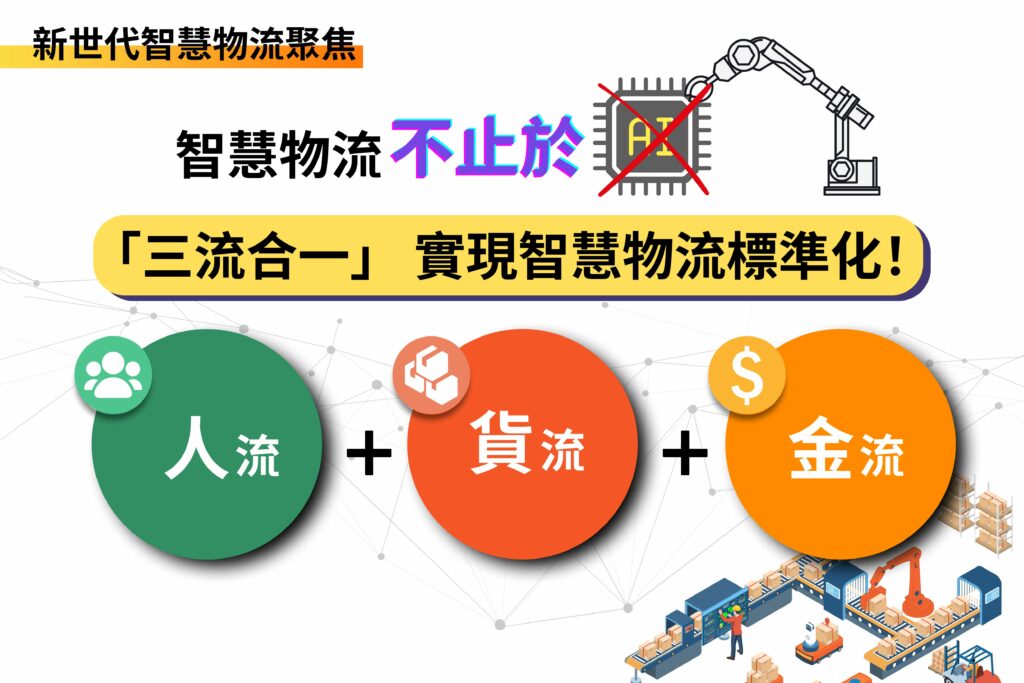

Smart Logistics Goes Beyond “AI” – Unify the Three Flows for Smart Logistics Standardization

“Smart Logistics” should be about enhancing the stability of the supply chain and achieving smooth operation of the logistics supply chain, with AI as just one component.

Promoting Environmental Upcycling and Uniting Social Forces to Realize Inclusion

Reiter volunteer team recently participated in the “Food Sharing Project” volunteer activity organized by the New Life Psychiatric Rehabilitation Association. This was the second time the event was held, with a new handcraft workshop component added this year.