Exploring the ‘Super Capital Engine’ of Smart Logistics: Five Key Benefits of RBF!

- September 12, 2024

As mentioned in the last article, revenue-based financing (RBF) has become a financial lifeline for the logistics industry! Not only that, RBF is increasingly becoming a key driver in the smart logistics sector. This model not only alleviates companies’ financial pressures but also fosters innovation and market expansion.

Here are the 5 key advantages of RBF for the development of smart logistics:

1) Reduced Financial Risk:

RBF offers financing based on a company’s actual revenue, allowing businesses to repay funds in proportion to their income. This method significantly lowers the financial risks associated with traditional loans, providing companies with much-needed flexibility during uncertain economic times.

2) Fostering Technological Innovation:

Since RBF does not require fixed repayments, businesses can allocate more funds toward technological advancements and system upgrades, enhancing operational efficiency. This flexibility encourages ongoing innovation in the smart logistics industry, strengthening a company’s competitive edge.

3) Accelerating Capital Flow:

RBF enables rapid access to funding, helping businesses quickly respond to market demands and shorten capital turnover times. This is especially crucial for smart logistics companies that are aiming for rapid growth.

4) Flexible Financing Structure:

The repayment structure of RBF is tied to a company’s revenue, allowing businesses to maintain financial stability in the face of seasonal fluctuations or market uncertainties. This support is vital for smart logistics companies as they navigate future challenges.

5) A Win-Win for Investors and Businesses:

The transparency and flexibility of the RBF model attract more investors, providing logistics companies with additional funding sources to fuel their expansion and development. For investors, this model offers the potential for cash flow and growth from advanced logistics industry assets.

In summary, Revenue-Based Financing (RBF) presents new financing opportunities for smart logistics companies, driving continuous innovation and rapid growth in the industry. With ongoing capital infusion, the prospects for smart logistics are exceptionally bright.

Other News

- All Post

- Press Room

As a pioneer in logistics technology and supply chain innovation, Reitar today (26/6) announced a strategic MOU—marking a forward-looking collaboration—joining hands with Rich Harvest, a leading Asian smart agriculture enterprise, to build a smart agriculture ecosystem.

Reitar Logtech today announced plans to spin off its logistics automation segment. This follows our recent acquisition of Jingxing Storage Equipment Engineering (Hong Kong) Limited, which has been integrated as a subsidiary of our group.

Reitar is honored to announce its dual achievement at the 2024-2025 Digital Accessibility Awards, receiving both the Gold Award and Elderly-Friendly Award for outstanding contributions to inclusive technology.

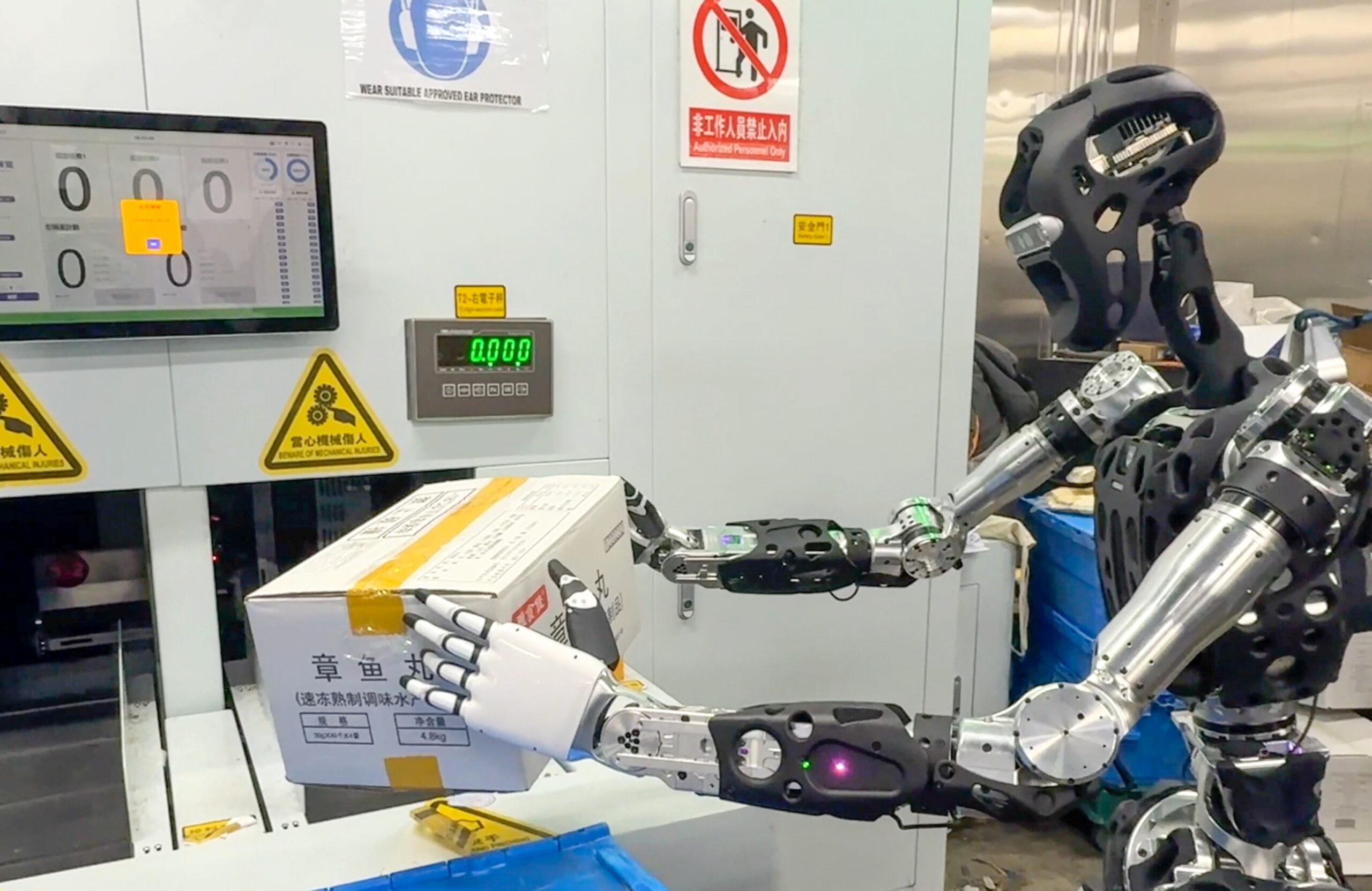

Today's logistics industry is experiencing a wave of intelligent transformation. Recently, industry leader Reitar Logtech Group (NASDAQ: RITR) partnered with AI pioneer NEXX to announce a renewed strategic collaboration. Both parties will leverage their resource strengths to launch the first humanoid robot designed specifically for logistics operations in Hong Kong, revolutionizing logistics operations and creating a new smart logistics ecosystem...