New Norm in Logistics Real Estate Investment – (2) Demand-Driven Investment Model

- December 19, 2023

After understanding the role of the logistics industry in Hong Kong within the Greater Bay Area, we can explore models for investing in logistics real estate to meet investor needs and find a comprehensive investment strategy.

Traditional Logistics Real Estate Investment Model: ‘Build Warehouses, Then Attract Tenants’

Traditionally, real estate funds have preferred commercial properties like offices, hotels, shopping malls, and residential projects. They have shown less interest in traditional industrial assets, considering them lower growth and returns.

However, demand for traditional investment sectors has declined after the pandemic and under low economic growth in recent years. As a result, many real estate funds have become more conservative and shifted towards stable rental income from industrial or logistics real estate investments.

Logistics real estate is complex, standardized and highly specialized investment. Investors must understand logistics operations’ needs to increase asset value effectively. The Challenges are how to invest in Logistics Real Estate? Or how to secure the stable returns?

New Investment Model: Tenant Demand Prioritization

For investors, returns are paramount. The traditional model of ‘building warehouses, then attracting tenants’ raises doubts about returns. Instead, adopting a tenant-priority and demand-driven approach ensures stable income by involving tenants or operators in logistics assets.

Reitar Logtech Group has established a Property + Logistics Technology solution platform to identify stable, high-return investment projects for real estate funds. By prioritizing tenant demand, Reitar seeks operators and users/tenants to address demand issues and satisfy logistics operators’ needs for improved efficiency and competitiveness with lighter assets. Simultaneously, leveraging Hong Kong’s advantages in the Greater Bay Area logistics region, they collaborate with cities in the area to discover suitable investment opportunities.

Other News

- All Post

- Greater Bay Alliance

The long-awaited Shenzhen-Zhongshan Bridge has finally passed its completion inspection on June 16th. This infrastructure marvel, comprising an underwater tunnel through the Pearl Riverbed and a cross-sea highway bridge, will connect the two cities and slash their travel time to just 30 minutes.

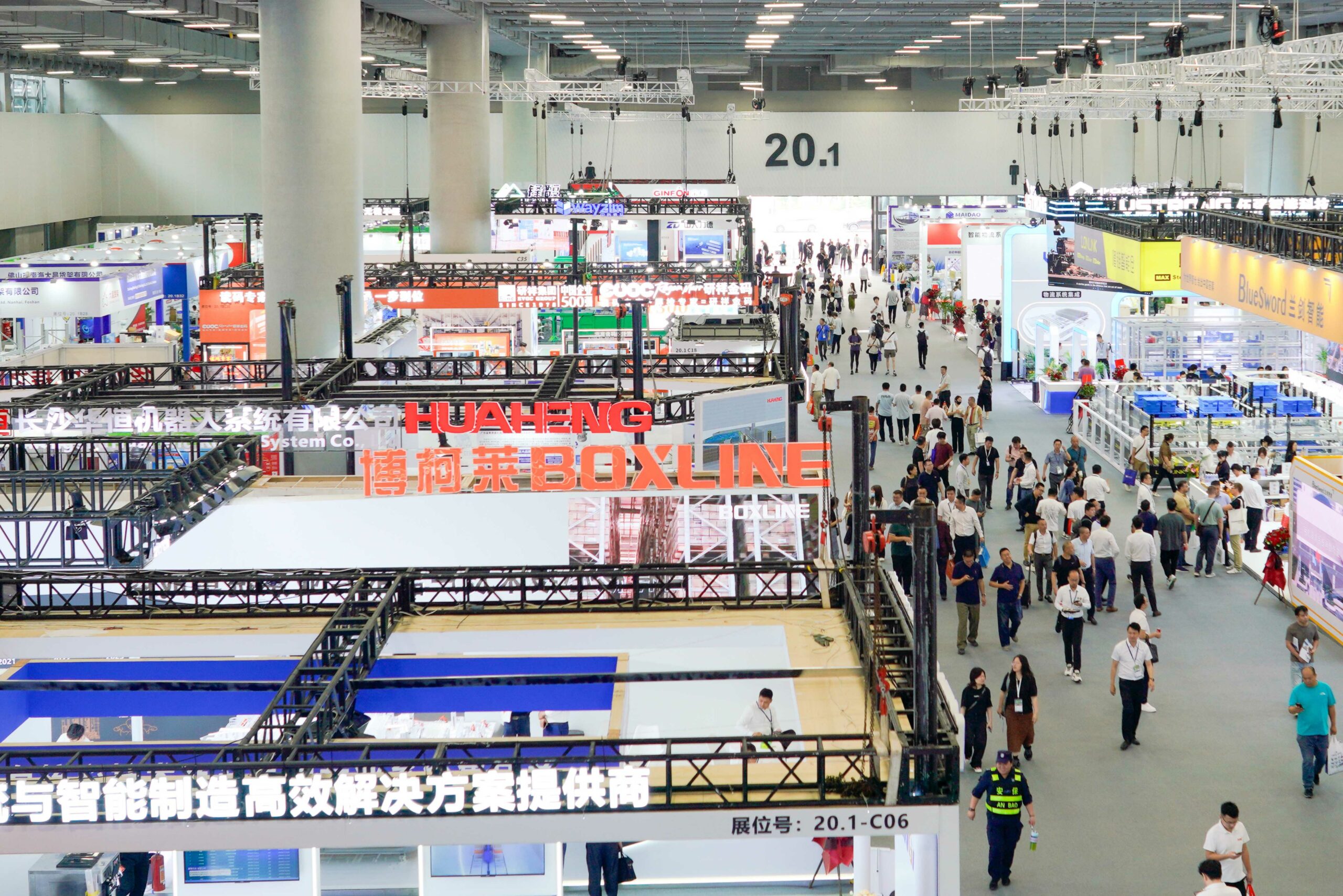

The 15th LET - a CeMAT Asia Event was officially unveiled recently, held for three consecutive days (May 29-31) at the Guangzhou China Import & Export Fair Complex.

Asset partners comprise capital investors and real estate providers with financial resources and physical logistics properties such as warehouses, logistics centers, and distribution centers. Both parties are driven by achieving long-term stable returns and asset appreciation, but they may need more experience in operating logistics assets.

With the increasing demand for online shopping, the logistics industry faces significant challenges and opportunities. To meet the growing needs, logistics operators must invest substantial funds in acquiring new logistics equipment, such as automation, intelligence, and digitization, to enhance operational efficiency and service levels. However, such investments can be a significant burden for many logistics operators.