“Property + Logistics Technology” PLT Platform – (4) Asset Partners

- February 15, 2024

Asset partners play a crucial role in the smart logistics ecosystem of the “Property + Logistics Technology” PLT platform.

Asset partners comprise capital investors and real estate providers with financial resources and physical logistics properties such as warehouses, logistics centers, and distribution centers. Both parties are driven by achieving long-term stable returns and asset appreciation, but they may need more experience in operating logistics assets. However, the ecosystem within the PLT platform can complement their logistics operations and enhance their asset capabilities.

Who are the Asset Partners?

Capital investors play a vital role within the PLT platform. They invest funds in developing logistics assets and seek stable investment returns. These investors may include institutional investors or other capital sources seeking long-term stable returns.

By collaborating with the PLT platform, they can actively participate in developing and managing logistics properties, thereby achieving asset appreciation. These investors work closely with logistics asset funds to jointly manage and invest in logistics projects, such as automated warehouses, cold chain storage, e-delivery centers, distribution centers, and logistics parks. Leveraging logistics technology applications enables these logistics assets to operate more efficiently, attracting stable rental income.

Secondly, real estate providers are also significant participants within the PLT platform. They own logistics properties, such as warehouses and logistics centers, boasting strategic locations and modern facilities.

These real estate providers collaborate with the PLT platform to develop valuable logistics real estate projects. For instance, they establish partnerships with local governments in the Greater Bay Area, including Zhuhai and Shenzhen, to identify suitable logistics properties. The PLT platform offers comprehensive support for investment projects, encompassing everything from planning to design, ensuring optimal outcomes for sustainable development. Through their collaboration with the PLT platform, real estate providers can leverage logistics technology’s advantages, enhance logistics real estate’s value, and secure stable rental income.

Navigating Profitable Avenues in Logistics

Within the PLT platform’s ecosystem, asset partners are not merely investors and real estate providers; they also have the opportunity to explore additional business prospects and value-added services through connections with logistics technology providers and other business partners. This partnership includes establishing venture capital funds to invest in innovative and promising projects, spanning logistics technology, warehouses, logistics real estate, and inventive machinery technologies. For example, they can collaborate with logistics operators and e-commerce platforms to offer diversified services such as warehouse leasing, third-party storage, and order fulfillment. Moreover, asset partners can provide value-added services such as packaging, label printing, and product display to meet customer needs, enhancing customer loyalty and competitiveness.

Asset partners are pivotal in this ecosystem, capitalizing on collaboration with the platform and partners to achieve asset appreciation and seize business opportunities.

Other News

- All Post

- Greater Bay Alliance

The long-awaited Shenzhen-Zhongshan Bridge has finally passed its completion inspection on June 16th. This infrastructure marvel, comprising an underwater tunnel through the Pearl Riverbed and a cross-sea highway bridge, will connect the two cities and slash their travel time to just 30 minutes.

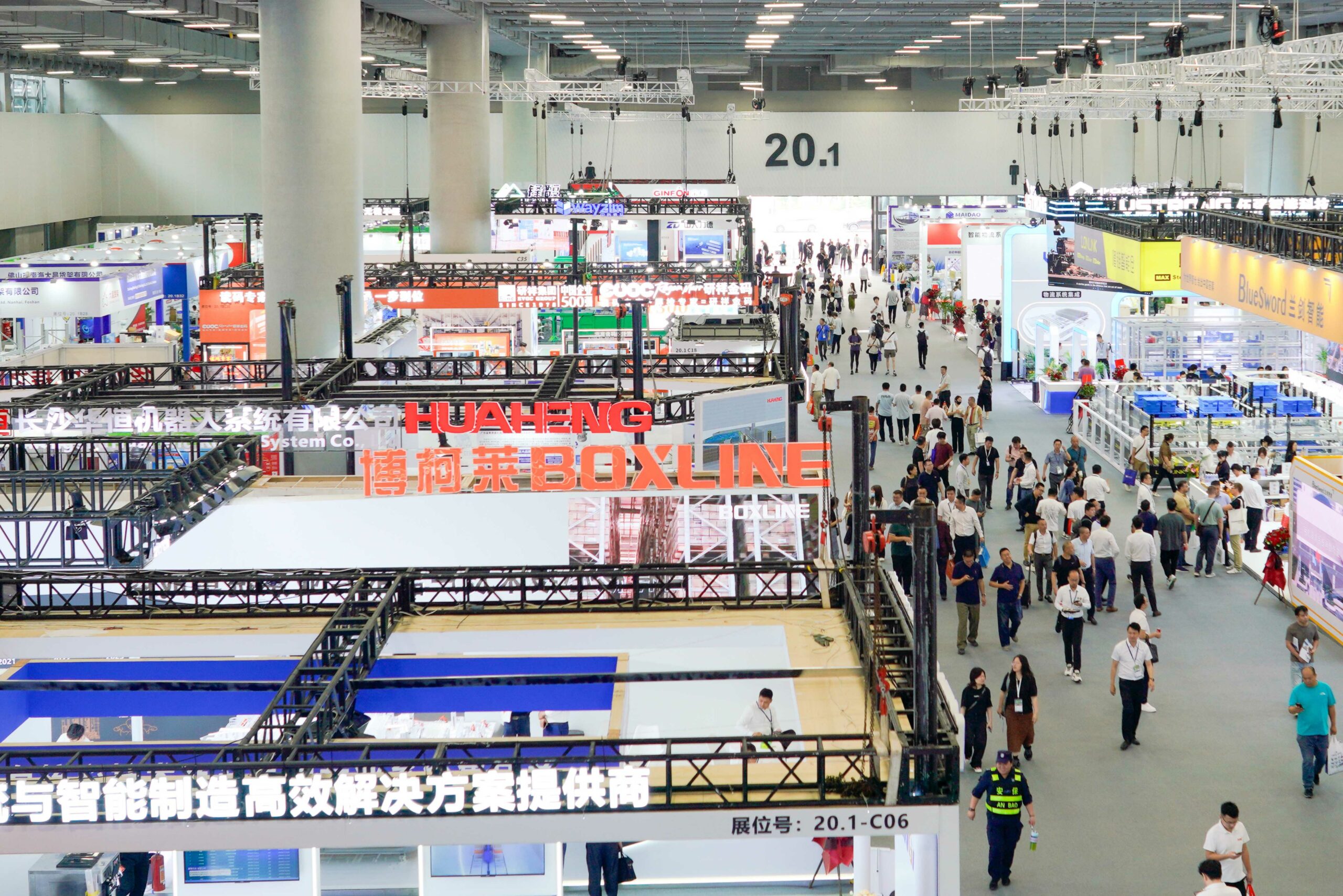

The 15th LET - a CeMAT Asia Event was officially unveiled recently, held for three consecutive days (May 29-31) at the Guangzhou China Import & Export Fair Complex.

Asset partners comprise capital investors and real estate providers with financial resources and physical logistics properties such as warehouses, logistics centers, and distribution centers. Both parties are driven by achieving long-term stable returns and asset appreciation, but they may need more experience in operating logistics assets.

With the increasing demand for online shopping, the logistics industry faces significant challenges and opportunities. To meet the growing needs, logistics operators must invest substantial funds in acquiring new logistics equipment, such as automation, intelligence, and digitization, to enhance operational efficiency and service levels. However, such investments can be a significant burden for many logistics operators.