New Norm in Logistics Real Estate Investment – Hong Kong Retail Supply Chain Model

- November 28, 2023

When investing in logistics real estate, it is essential to understand the current market and industry conditions. As an investor, it is advisable first to gain an overview of the logistics industry in Hong Kong and then understand the models for investing in logistics real estate.

By exploring the retail supply chain in Hong Kong, one can better understand the advantages and disadvantages of the logistics industry in Hong Kong.

In the traditional retail supply chain, products are transported from the production site to the sales location and then transferred to warehouses in Hong Kong as reserves through customs procedures. However, this approach has limitations in meeting rapidly changing demand. Warehouses close to retail points usually have limited inventory and slower replenishment speeds, making it difficult to respond to sudden demands, such as during the holidays. Additionally, the rental costs for warehouses serving as significant export hubs in Hong Kong are relatively high, which presents a challenge.

“Maximizing Supply Chain Efficiency by Establishing Replenishment Warehouses”:

To address these issues, international retailers and domestic brands engaged in foreign sales often use Hong Kong as their primary sorting warehouse to reduce warehouse space. In contrast, domestic warehouses serve as secondary warehouses, with Guangdong Province becoming a replenishment hub for many retail brands. Many international retailers such as Adidas, Nike, and China Resources have established secondary warehouses as replenishment centers in the South China region. The Hezhou New Area in Zhuhai is a good example, as it can serve as a replenishment warehouse for retail brands, being close to retail points in Hong Kong, thus saving time and offering relatively lower rental costs. (More detail about Zhuhai : https://bit.ly/47fawK5 )

Reitar Logtech Group leverages Hong Kong’s advantages in the Greater Bay Area. It proposes an advantageous strategy, using Hong Kong as the primary sorting warehouse and Zhuhai as the secondary warehouse for replenishment. This approach provides a comprehensive solution for investors, operators, and end customers/tenants.”

Other News

- All Post

- Greater Bay Alliance

The long-awaited Shenzhen-Zhongshan Bridge has finally passed its completion inspection on June 16th. This infrastructure marvel, comprising an underwater tunnel through the Pearl Riverbed and a cross-sea highway bridge, will connect the two cities and slash their travel time to just 30 minutes.

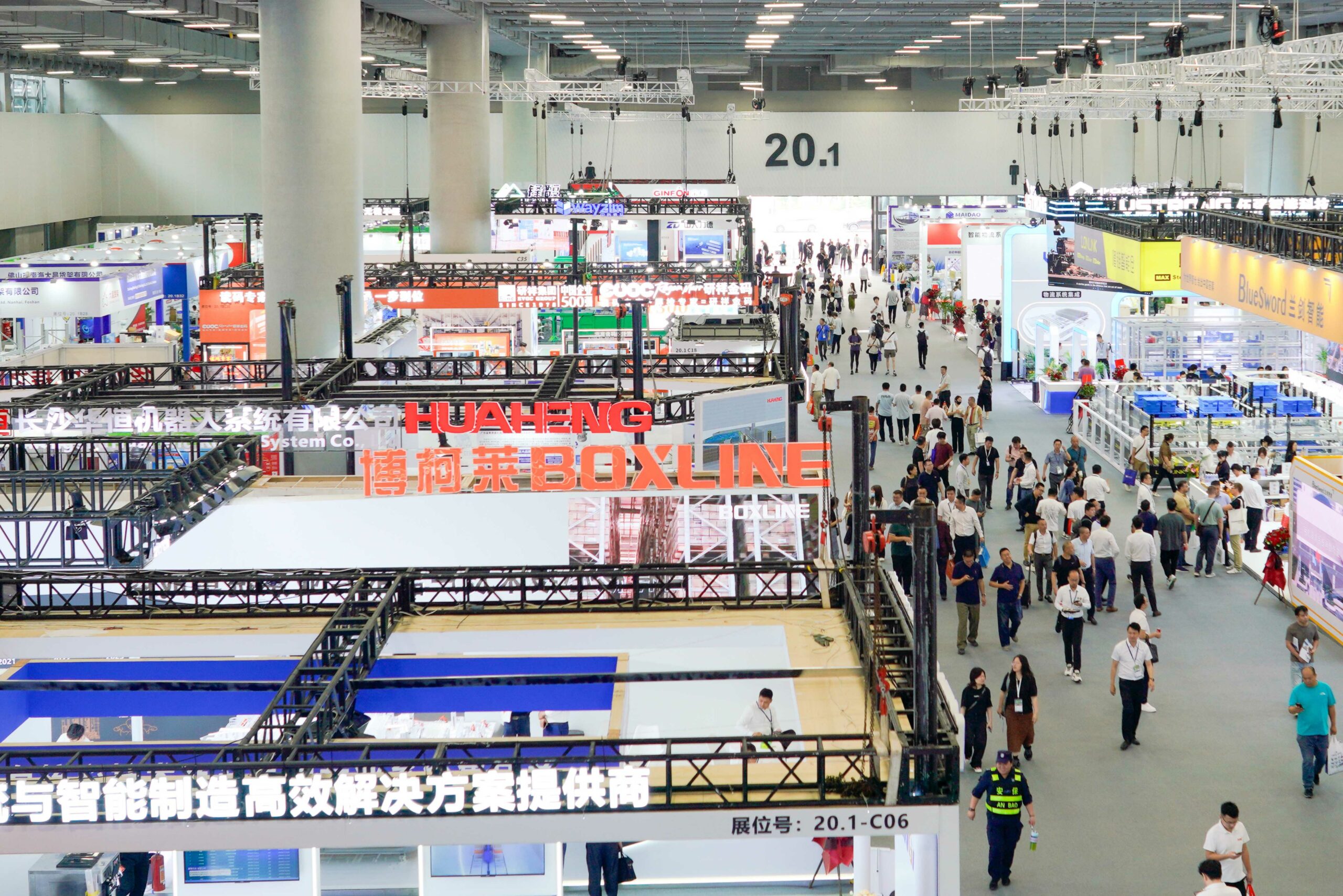

The 15th LET - a CeMAT Asia Event was officially unveiled recently, held for three consecutive days (May 29-31) at the Guangzhou China Import & Export Fair Complex.

Asset partners comprise capital investors and real estate providers with financial resources and physical logistics properties such as warehouses, logistics centers, and distribution centers. Both parties are driven by achieving long-term stable returns and asset appreciation, but they may need more experience in operating logistics assets.

With the increasing demand for online shopping, the logistics industry faces significant challenges and opportunities. To meet the growing needs, logistics operators must invest substantial funds in acquiring new logistics equipment, such as automation, intelligence, and digitization, to enhance operational efficiency and service levels. However, such investments can be a significant burden for many logistics operators.