New Norm in Logistics Real Estate Investment-(3)Mismatch Between Logistics Industry and Investors

- January 2, 2024

In addition to understanding the new investment model of “Tenant Priority, Demand-Driven,” Reitar Logtech Group also recognizes the mismatch between the logistics industry and investors.

The development of the logistics industry drives continuous increases in the value of logistics assets, attracting more and more attention from real estate funds and investors. On the other hand, logistics efficiency and quality not only affect consumer experience but also relate to business competitiveness and costs. Therefore, the logistics industry needs continuous innovation and transformation to meet changing market demands. However, many differences exist between the logistics industry and investors in asset utilization and returns, leading to a “mismatch” of approaches.

The logistics operators lack funds:

The logistics operators need help innovating and transforming – a shortage and mismatch of funds. On the one hand, they must invest a lot of money to purchase new logistics equipment such as automation, intelligence, and data to improve operational efficiency and service levels. However, this equipment often involves heavy asset investments, which burdens logistics operators pursuing light asset operations.

Investors lack logistics experience:

Real estate funds are highly interested in logistics properties because of stable rental income and appreciation potential. However, these investors often need an understanding of logistics operators’ needs and characteristics, only focusing on the asset value while ignoring the underlying operational model and tech support.

Mismatch scenario:

In this situation, there needs to be a better match between the logistics industry and investors in their approaches. Logistics operators need funds to support innovation and transformation but are reluctant to take on heavy asset risks. Investors have funds to invest in logistics properties but need to know how to increase their value and returns. This mismatch has led to a situation where demand needs more supply, and supply needs more demand in the market.

So, how do we break this deadlock? Reitar Logistics Technology Group provides a win-win solution through its “Property + Logistics Technology” integrated development platform.

Please continue to pay attention to the PLT Platform updates.

Other News

- All Post

- Greater Bay Alliance

The long-awaited Shenzhen-Zhongshan Bridge has finally passed its completion inspection on June 16th. This infrastructure marvel, comprising an underwater tunnel through the Pearl Riverbed and a cross-sea highway bridge, will connect the two cities and slash their travel time to just 30 minutes.

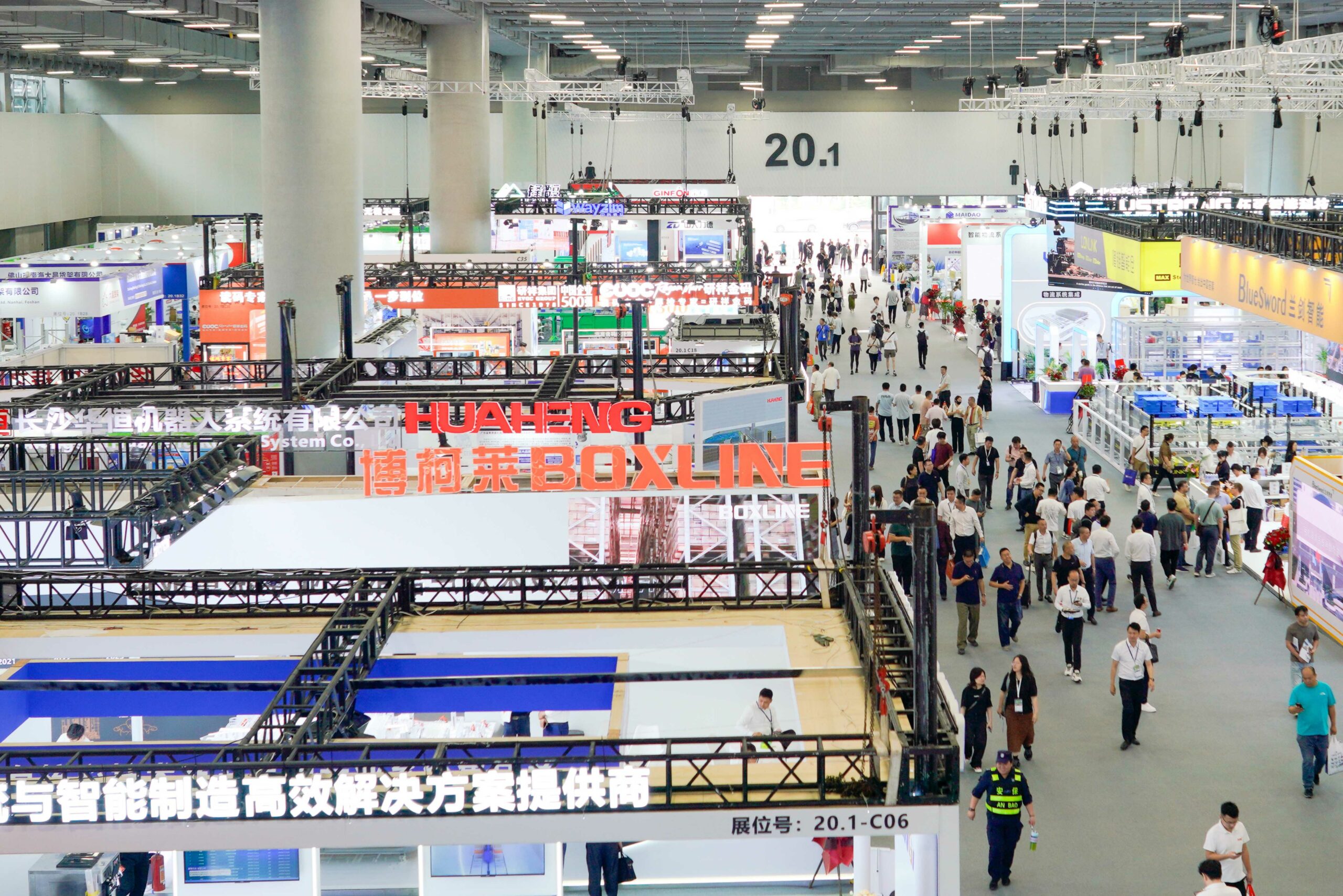

The 15th LET - a CeMAT Asia Event was officially unveiled recently, held for three consecutive days (May 29-31) at the Guangzhou China Import & Export Fair Complex.

Asset partners comprise capital investors and real estate providers with financial resources and physical logistics properties such as warehouses, logistics centers, and distribution centers. Both parties are driven by achieving long-term stable returns and asset appreciation, but they may need more experience in operating logistics assets.

With the increasing demand for online shopping, the logistics industry faces significant challenges and opportunities. To meet the growing needs, logistics operators must invest substantial funds in acquiring new logistics equipment, such as automation, intelligence, and digitization, to enhance operational efficiency and service levels. However, such investments can be a significant burden for many logistics operators.